Navigating the Ups and Downs: A Comprehensive Analysis of Global Stock Markets

Comprehensively analyze the fluctuations in global stock markets. Gain insights into market dynamics, trends, and factors affecting the volatility of stock exchanges worldwide

Introduction to Global Stock Markets

As an investor, understanding the intricacies of global stock markets is crucial for making informed decisions. The world of stocks can be both exhilarating and daunting, with its constant fluctuations and unpredictable nature. In this article, we will delve into the depths of global stock markets, exploring the factors that drive market movements and how investors can navigate the ups and downs.

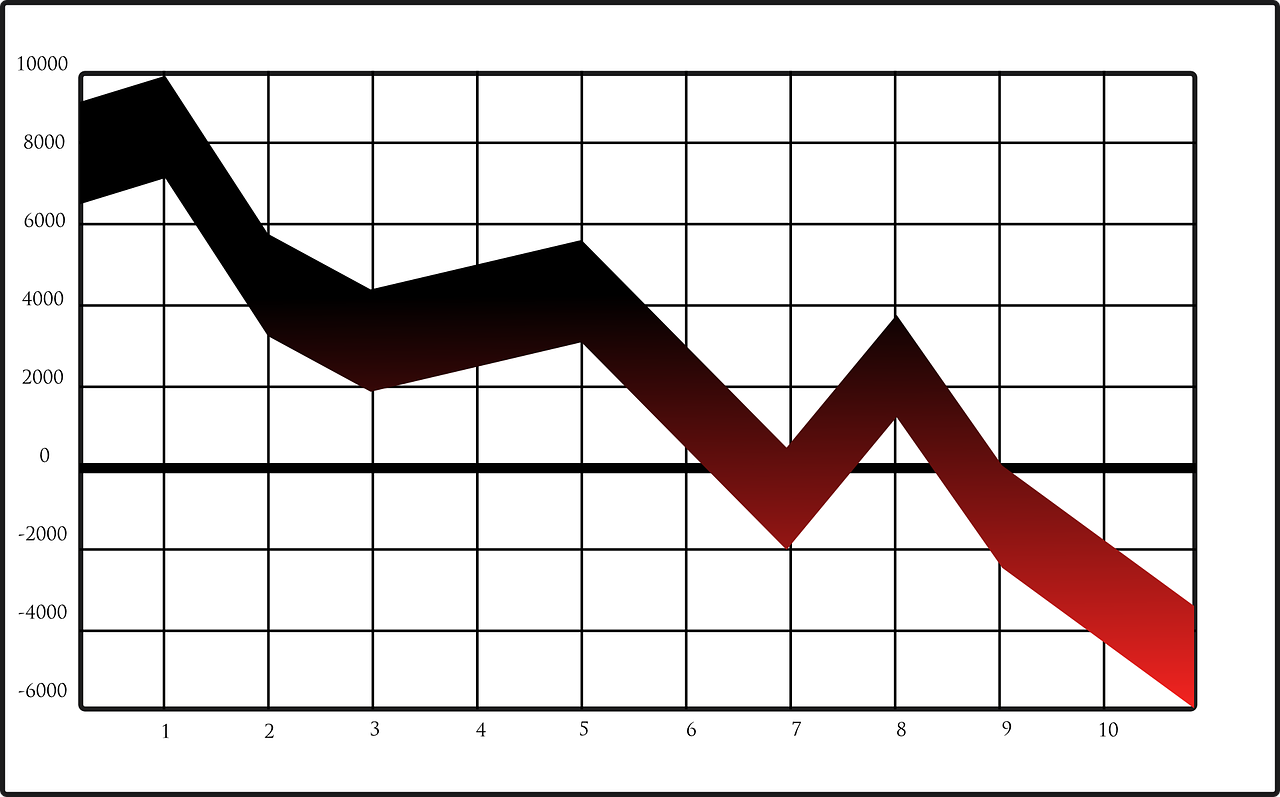

Understanding Market Fluctuations and Volatility Analysis

Market fluctuations are an inherent part of global stock markets. Prices can soar one day and plummet the next, leaving investors bewildered. To navigate these fluctuations, it is essential to conduct volatility analysis. This analysis involves assessing the degree of variation in stock prices over time. By understanding volatility, investors can gauge the potential risks associated with specific stocks and make informed decisions.

The Role of Investor Sentiment in Stock Markets

Investor sentiment plays a significant role in shaping global stock markets. The emotions and perceptions of investors can greatly impact market movements. When investors are optimistic, they tend to buy stocks, driving prices higher. Conversely, when pessimism abounds, investors may sell their stocks, causing prices to fall. Understanding investor sentiment can provide valuable insights into market trends and help investors make strategic decisions.

Key Economic Indicators Affecting Global Stock Markets

Global stock markets are deeply intertwined with the broader economy. Key economic indicators, such as GDP growth, inflation rates, and employment figures, have a substantial impact on stock market performance. When the economy is thriving, stock markets tend to follow suit. Conversely, economic downturns can spell trouble for stocks. By monitoring these indicators, investors can anticipate market movements and adjust their strategies accordingly.

Analyzing Market Trends and Investment Behavior

Market trends and investment behavior are closely linked in global stock markets. Investors often follow trends, buying stocks that are performing well and selling those that are underperforming. This herd mentality can lead to market inefficiencies and opportunities for astute investors. By analyzing market trends and understanding investment behavior, investors can position themselves advantageously and capitalize on emerging opportunities.

Exploring Stock Market Dynamics and Economic Uncertainty

Stock market dynamics are influenced by a myriad of factors, including economic uncertainty. Uncertainty can arise from geopolitical tensions, policy changes, or unforeseen events. During times of uncertainty, stock prices can be highly volatile, making it challenging for investors to navigate the markets. However, by staying informed, conducting thorough research, and diversifying their portfolios, investors can weather economic uncertainty and mitigate risks.

Identifying Trading Patterns and Conducting Market Analysis

Trading patterns can provide valuable insights into global stock markets. By analyzing historical price data, investors can identify recurring patterns and trends. This analysis can help investors predict future market movements and make informed trading decisions. Additionally, conducting market analysis through fundamental and technical analysis can provide a comprehensive understanding of stock market dynamics and aid in decision-making.

Risk Assessment in Global Stock Markets

Risk assessment is a critical aspect of investing in global stock markets. Every investment carries a certain degree of risk, and understanding and managing these risks is essential for long-term success. Investors should assess various risk factors, such as market risk, company-specific risk, and liquidity risk, before making investment decisions. By diversifying their portfolios and conducting thorough risk assessments, investors can protect themselves against potential losses.

The Impact of the Global Economy on Stock Markets

Global stock markets are intricately linked to the global economy. Economic events and trends can have a profound impact on stock market performance. Factors such as interest rates, trade policies, and currency fluctuations can significantly influence stock prices. By staying informed about the global economy and its impact on stock markets, investors can make informed decisions and position themselves advantageously.

Conducting Financial Analysis for Stock Investments

Financial analysis is a crucial tool for evaluating stock investments. By examining a company's financial statements, investors can assess its financial health, profitability, and growth prospects. Fundamental analysis, which involves examining a company's financial ratios and performance metrics, can provide valuable insights into the company's value and potential for future growth. Through comprehensive financial analysis, investors can make sound investment decisions.

Building Investor Confidence Through Economic Forecasts

Economic forecasts can help build investor confidence in global stock markets. By examining economic indicators and trends, analysts can make predictions about future economic performance. These forecasts can guide investors in making strategic investment decisions and provide reassurance in times of uncertainty. However, it is important to note that economic forecasts are not foolproof and should be used as one of many tools in the investment decision-making process.

Evaluating Stock Valuations and Market Performance

Evaluating stock valuations is crucial for assessing market performance. A stock's valuation can provide insights into its relative worth and potential for future growth. By comparing a stock's price to its earnings, book value, and other valuation metrics, investors can determine whether a stock is overvalued or undervalued. Understanding market performance and evaluating stock valuations can help investors make informed investment decisions.

Ensuring Financial Stability in Global Stock Markets

Financial stability is paramount in global stock markets. Investors must ensure that their investments are protected and that they have the necessary resources to weather market downturns. By diversifying their portfolios, setting realistic financial goals, and regularly reassessing their investment strategies, investors can safeguard their financial stability. Additionally, staying educated about market trends and seeking professional advice can contribute to financial stability.

Conclusion: Navigating the Ups and Downs of Global Stock Markets

Global stock markets are complex and ever-changing, but with knowledge and strategic decision-making, investors can navigate the ups and downs. By understanding market fluctuations, investor sentiment, economic indicators, and conducting thorough analysis, investors can make informed investment decisions. Remember to assess risks, evaluate stock valuations, and stay informed about the global economy. With a comprehensive approach and a focus on financial stability, investors can thrive in global stock markets.

CTA: Stay informed and make strategic investment decisions. Start navigating global stock markets today!

For an article titled "Global Stock Market Fluctuations: Analyzing Recent Volatility and Investor Sentiment," the keywords could be:

Global Stock Markets, Market Fluctuations, Volatility Analysis, Investor Sentiment, Financial Markets, Economic Indicators, Market Trends, Investment Behavior, Stock Market Dynamics, Economic Uncertainty, Trading Patterns, Market Analysis, Risk Assessment, Global Economy, Financial Analysis, Investor Confidence, Economic Forecasts, Stock Valuations, Market Performance, Financial Stability.